Customer Lifetime Value (CLV)

Contents

Definition

The term “customer lifetime value” (often abbreviated as CLV) is a marketing concept that quantifies the total monetary value a given customer provides through the purchase of products or services. This figure spans the entire lifetime of a customer, defined as the duration of their relationship with a company.

The concept of customer lifetime value plays a crucial role in business planning, marketing, and budgeting. Quantifying the CLV can help business owners determine the adequate levels of investment needed for each customer or customer group. This concept is closely linked to profitability and decision making.

Calculating the CLV

There are several ways of calculating customer lifetime value rates. Key concepts in this calculation include the customer’s monetary contribution, the duration of their relationship with a company, and the cost of the resources involved in acquiring and retaining the customer.

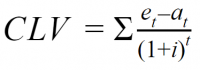

When these concepts are put together, a standard CLV formula would look like this:

CLV = average value of a customer’s purchase * amount of purchases made over a specific time frame (e.g. one year) * anticipated duration of the relationship between client and company.

Exemplary Calculation

For illustration, let us assume we are trying to calculate the customer lifetime value of two types of clients interested in a gym membership. Using the formula above, we would carry out the following calculation:

Client 1: A person who wants to get into shape for the summer.

$50 (average value of the customer’s purchase) * 6 (the number of times this amount will be spent over one year) * 1 (the anticipated duration of the relationship between the client and the gym).

$50 * 6 * 1 = $300

Client 2: A person who is looking to incorporate exercise into their lifestyle on a permanent basis.

$50 (average value of the customer’s purchase) * 12 (the number of times this amount will be spent over one year) * 5 years (the anticipated duration of the relationship between the client and the gym).

$50 * 12 * 5 = $3,000

With these figures in mind, the gym owner would reap better profits by directing their marketing efforts towards client type 2.

More complex formulas for the customer lifetime value also consider factors such as marketing expenses, profit margin, and the discounting factor. The most commonly used formula for the CLV of a customer is the following:

Figure: Formula to calculate the customer lifetime value, Author: Seobility

- t = business period

- et = customer-specific payments in accounting period t (e.g. turnover)

- at = customer-specific expenditures in accounting period t (e.g. advertising expenditures, personal telephone calls)

- i = calculation interest rate (the interest rate at which future income is discounted)

How to optimize the CLV

One important thing to note about the concept of customer lifetime value is that this is not a fixed figure. You can optimize the CLV in many ways.

- Making promotional offers, such as coupons, discount vouchers, and sales.

- Offering added value to a select group of customers (ideally those with a high CLV). Some examples include loyalty programs, membership schemes, VIP services, priority shipping, etc.

- Offering products and services in alternative formats to match all preferences. Examples include paper books and e-books, online shops, and brick-and-mortar or pop up shops.

- Personalizing your communications based on the customer’s interests. For instance, instead of sending the same email marketing campaign to all your customers, you would segment your database looking at past purchases and other data, and send emails promoting the products or services that are most likely to lead to conversion for each segment.

- Delivering customer service via multiple channels. For example, ensuring customers can contact you via phone call, email, SMS, live chat, or in-store.

- Creating products or services that complement each other. For instance, a company selling coffee beans could also start selling coffee mugs, thermos, or coffee makers.

- Mapping your customer journey and identifying the main obstacles at every stage.

An example is the Starbucks Reward System. They offer points for loyal customers which can be used to get free coffee, for example.

Screenshot showing Starbucks Rewards of starbucks.com

Importance in marketing

Knowing your CLV is important because it can help you streamline your operations and fine-tune your marketing campaigns so they are more effective. Once you identify clients with a high customer lifetime value, you can direct more resources towards acquisition and retention strategies. In this way, the CLV becomes a crucial tool that can help make informed and data-rich decisions. In turn, this can take the guesswork out of your marketing efforts and make the entire process more customer-centric and analytical.

Criticism of the customer lifetime value

Although determining the CLV is useful, the calculations should not be taken as hard science. Some drawbacks to the idea of the customer lifetime value.

First, the formula or calculation is based on assumptions about the future. It is hard to predict elements of the formula, such as purchase frequency or the duration of the relationship between a client and a brand since there are many variables that can affect this. Moreover, some of these variables are beyond the control of business owners.

Another drawback is that some of the information used to determine the customer lifetime value is not as objective as it seems. After all, the formulas rely on average values, which are not always representative of every customer.

Lastly, focusing on retaining customers with a high CLV can lead business owners to overlook new customer acquisition strategies. This is why CLV calculations should be used as a guideline with a focus on both acquiring new customers and retaining existing ones.

Related articles

- https://www.thinkwithgoogle.com/marketing-resources/experience-design/maximizing-customer-lifetime-value/

- https://medium.com/gobeyond-ai/customer-lifetime-value-what-is-it-why-is-it-important-and-how-to-improve-it-260458f14176

Similar articles

| About the author |

|